- +1

【双语话个税】3月21日起,个税年度汇算无需预约即可办理。如何操作看这里→ 标准申报操作篇 。

问

我想办理2023年度综合所得汇算清缴,我要怎么操作申报呢?

I want to make 2023 individual income annual settlement. How to declare?

答

3月21日起,您无需预约即可直接在手机办理。

From March 21st, there is no need to make an appointment and you can directly handle it via mobile phone.

下面,申税小微带大家了解如何通过手机进行标准申报→→

Next, let’s learn how to make standard individual income tax annual settlement via mobile phone.

01

进入申报

Initiate the declaration

点击首页“2023综合所得年度汇算”专题【开始申报】,也可以通过页面下方的“办&查”-“综合所得年度汇算”发起申报。

Click [Start the declaration] in the thematic area titled “2023 comprehensive individual income annual settlement” on the home page or click “handle & check” at the bottom of the page - “comprehensive individual income annual settlement” to start the declaration.

02

核对信息

Check the information

①阅读标准申报须知(申报表预填服务),点击【我已阅读并知晓】

Read the standard declaration instructions (declaration form pre-filling service) and click [I have read and known].

Tips:

使用“预填服务”,您也需要据实对预填的信息进行确认、补充或完善。

When you use the “pre-filling service”, you also need to confirm, supplement, or refine the pre-filled information according to the facts.

②仔细核对个人基础信息和汇算地,确认无误后点击【下一步】。

Carefully check the basic personal information and the settlement place and click [Next] after confirmation.

认真核对已填报的综合所得收入、费用、免税收入和税前扣除。

Carefully check the reported comprehensive income, expenses, tax-free income and pre-tax deduction.

③如存在奖金,请在详情页中进行确认。在奖金计税方式选择上,您可以重新选择将全年一次性奖金收入并入综合所得计税,也可以选择其中一笔奖金单独计税。奖金计税方式的选择,将会影响汇算的税款计算结果,请您根据自身情况进行选择。

If you have a bonus, please confirm it in the detail page. In the selection of its tax calculation method, you can re-choose to incorporate the annual one-time bonus income into the comprehensive income to calculate tax, or you can treat bonuses separately. The choice of bonus tax calculation method will affect the tax outcome of the annual settlement. Please choose your method according to your situation.

④如需新增专项附加扣除项目,可点击右上角【新增】跳转至专项附加扣除采集页面进行填报。经认真核对已填报的综合所得收入、费用、免税收入以及捐赠等各项扣除项目无误后,点击【下一步】。

If you need to add an item for special additional deduction, you can click [Add] in the upper right corner, enter the information collection page of additional deduction and fill in it. If you have carefully checked the reported comprehensive income, expenses, tax-free income, donations, and other deduction items, please click [Next].

03

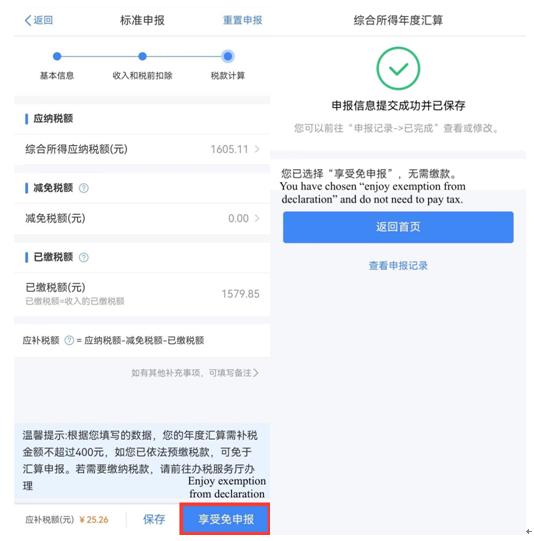

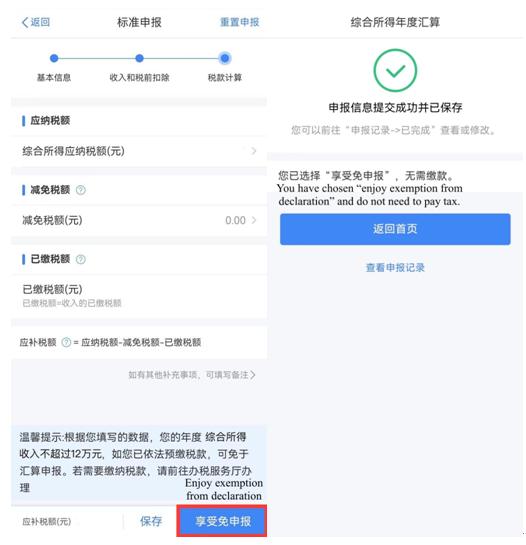

税款计算

Tax calculation

核对您的应纳税额、减免税额、已缴税额并在页面下方确认您的应补(退)税额,确认无误后点击【提交申报】,即可完成申报。

Check your tax payable, tax relief, tax paid and confirm your tax owed (refundable) at the bottom of the page. After the confirmation, click [Submit declaration] to complete the declaration

04

申请退税或补税

Apply for tax refundable

or owed

情 形 一 Situation 1:

如您存在应退税额,请点击【申请退税】。经税务机关和国库审核同意后,退税款即可直达您的银行账户。

If you have a tax refund, please click [Apply for tax refund].After the approval of the tax authority and the national treasury, the tax refund will be directly returned to your bank account.

情 形 二 Situation 2:

如您存在应补税额但补税金额不超过400元且已依法预缴个人所得税的,可免予年度汇算,您可点击【享受免申报】,无需缴纳税款。

If you have tax owed, and the amount does not exceed 400 yuan and you have paid individual income tax in advance according to law, you can be exempted from annual settlement. You can click [Enjoy exemption from declaration] and do not need to pay tax.

情 形 三 Situation 3:

如您存在应补税额但综合所得收入全年不超过12万元且已依法预缴个人所得税的,可点击【享受免申报】。

If you have tax owed, but your annual comprehensive income does not exceed 120,000 yuan, and you have paid individual income tax in advance according to law, you can click [Enjoy exemption from declaration].

情 形 四 Situation 4:

如您存在应补税额但不符合免予申报条件,请点击【立即缴税】,在确认支付金额后选择缴税方式并完成缴纳。

If you have tax owed but do not meet the requirements for exemption from declaration, please click [Pay tax immediately]. After confirming the payment amount, please choose the tax payment method and complete the payment.

******

供稿:蒋雨婷

继续滑动看下一个轻触阅读原文

上海税务向上滑动看下一个

原标题:《【双语话个税】3月21日起,个税年度汇算无需预约即可办理。如何操作看这里→ 标准申报操作篇 。》

本文为澎湃号作者或机构在澎湃新闻上传并发布,仅代表该作者或机构观点,不代表澎湃新闻的观点或立场,澎湃新闻仅提供信息发布平台。申请澎湃号请用电脑访问http://renzheng.thepaper.cn。

- 报料热线: 021-962866

- 报料邮箱: news@thepaper.cn

互联网新闻信息服务许可证:31120170006

增值电信业务经营许可证:沪B2-2017116

© 2014-2024 上海东方报业有限公司