- +1

夜读偶录 :凯恩斯以文传世

凯恩斯

作者简介:成小秦,1975年毕业于陕西师大外文系;1980年毕业于爱丁堡大学英文系。先后在对外翻译出版公司、联合国教科文组织,以及对外经贸大学工作。本文由作者授权发布。

01

1930年代,大萧条(The Great Depression)期间,经济学家们空谈而无策,如凯恩斯所言:从长远看,我辈都将逝去。如风暴来袭,经济学家仅能告知世人,暴风过后,海面将恢复平静,那么,其任务过于简单且无用。(In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. (A Tract on Monetary Reform)

凯恩斯提出失业理论,阐述政府行为何以促进充分就业。尽管凯氏备受保守派诋毁,但其挽救资本主义制度之策,远胜于所有亲市场的金融家们。当时,如采纳保守派方略,大萧条必将更为严重,而取代资本主义的呼声愈发强烈。(Making Globalization Work by Joseph Stiglitz)

《商业周刊》“伟大创新者”专栏称凯恩斯“资本主义拯救者”,名副其实。

哲人罗素(Bertrand Russell)曾言:吾人所学知识虽超越前代,但智慧阙如。(Knowledge and Wisdom)然而,论及好友凯恩斯,却盛赞其思维之敏锐、清晰,世所罕见,与之辩论,自感如痴人!

凯恩斯长于论辩,行文汪洋恣肆,以适己为用,撰写《就业、利息与货币通论》(The General Theory of Employment, Interest and Money),质疑经典学派,而提出新论,序言开宗明义:“本书面向同行经济学家而写。希望他人亦能理解。”为表述缜密思想,凯氏遣词务精,句式盘曲,所谓“渊深者多艰涩”,连经济学通才萨缪尔森(Paul Samuelson)都坦言,初读而不知所云,遑论他人!

《通论》汉译版本甚多,值得一评的惟商务印书馆两个版本:徐毓枬译文及高鸿业重译文。

徐毓枬先生1935年毕业于清华大学经济系,留学剑桥大学,师从著名经济学家琼·罗宾逊(Joan Robinson),聆听凯恩斯授课,1940年获经济学博士学位,返国后任教西南联合大学、清华大学及北京大学。

徐先生讲授凯恩斯《通论》,便着手迻译,1948年竣稿,延至1957年2月,才得以出版(三联书店)。先生不久沦为“右派”,英年而逝。《通论》1963年4月改由商务印书馆出版。

徐先生中英文俱佳,其《通论》汉译笔融文白,简约达意,虽有可商榷之处。

高鸿业先生重译《通论》,似应更进一步,臻于“信达雅”。然而,对照原文翻看几页,不免失望。译文冗赘,且趋于口语。学术名著如此汉译,会让国人误以为,凯恩斯学养不过尔尔。

《通论》序言(Preface):

The composition of this book has been for the author a long struggle of escape, and so must the reading of it be for most readers if the author’s assault upon them is to be successful,— a struggle of escape from habitual modes of thought and expression. The ideas which are here expressed so laboriously are extremely simple and should be obvious. The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.

商务印书馆《就业、利息与货币通论》徐毓枬译文:本书之作,对于作者是个长时期的挣扎,以求摆脱传统的想法与说法。设作者努力不虚,则大部分读者读此书时,想必会有同感。书中所含思想,虽然表达方式甚为复杂,实在是异常简单,应当人所共知。我们大多数都是在旧说下熏陶出来的。旧说已深入人心。所以困难不莅新说本身,而在摆脱旧说。

商务印书馆《就业、利息与货币通论》(重译本)高鸿业译文:对于作者而言,写作本书是一个长时期的挣扎过程,以求规避传统的想法和说法。如果作者对这些思想和说法的攻击是成功的话,那么,大多数读者在阅读本书时,也会持有同感。本书以如此复杂的方式所表达的思想却是很简单的。困难之处并不在于新思想,而在于旧学说。这些旧学说,对于我们这些大多数受其哺育而成长起来的人而论,已经深入到我们头脑中的每一个角落。

解析:a long struggle of escape ...... a struggle of escape from habitual modes of thought and expression.

徐译:长时期的挣扎,以求摆脱传统的想法与说法。

高译:长时期的挣扎过程,以求规避传统的想法和说法。

其实,a long struggle of escape 喻挣脱;竭力摆脱,而a struggle of escape from habitual modes of thought and expression正如陈寅恪先生言:脱心志于俗谛之桎梏。

...... which ramify, for those brought up as most of us have been, into every corner of our minds.

徐译:我们大多数都是在旧说下熏陶出来的。旧说已深入人心。

高译:这些旧学说,对于我们这些大多数受其哺育而成长起来的人而论,已经深入到我们头脑中的每一个角落。

“熏陶”、“哺育”、“已经深入到我们头脑中的每一个角落”,仍须推敲。

参考译文:撰写本书,对笔者而言,旨在奋力摆脱惯常思维及表达模式。倘若笔者努力不枉,则大多读者阅览本书时,必有同感。本书思想表述虽艰涩,然易懂且显见。我辈大多自幼深受旧说影响(浸染),因而,困难在于摆脱旧说,而非接受新说。

第一章 何为通论(CHAPTER I THE GENERAL THEORY)

I HAVE called this book the General Theory of Employment, Interest and Money, placing the emphasis on the prefix general. The object of such a title is to contrast the character of my arguments and conclusions with those of the classical theory of the subject, upon which I was brought up and which dominates the economic thought, both practical and theoretical, of the governing and academic classes of this generation, as it has for a hundred years past. I shall argue that the postulates of the classical theory are applicable to a special case only and not to the general case, the situation which it assumes being a limiting point of the possible positions of equilibrium. Moreover, the characteristics of the special case assumed by the classical theory happen not to be those of the economic society in which we actually live, with the result that its teaching is misleading and disastrous if we attempt to apply it to the facts of experience.

参考译文:本书名为《就业、利息和货币通论》,着重通字,旨在将笔者论点和结论比照经典学派论题。百年以降,经典学派主导政府及学界经济思想,无论实践及理论层面,而笔者从小亦受此教育。笔者认为,经典学派基本原理仅适用于特例,而非通例,其假设情况为可能均衡位置极限点。此外,经典学派假设之特例,并非现实经济社会所有,其结果,如将该学说付诸实践,必将世人引入歧途和灾难。

1979年,心理学家特沃斯基(Amos Tversky)与卡尼曼(Daniel Kahneman)发表《预期理论:风险下决策分析》(Prospect Theory: An Analysis of Decision under Risk),开创“行为经济学”。卡尼曼因此荣获2002年诺贝尔经济学奖。

行为经济学研究金融泡沫引发经济衰退的非理性心理冲动。该领域先驱之一,耶鲁大学教授席勒(Robert J. Shiller)引用“动物精神”(animal spirits)加以解释。经济周期依赖基本信任感,企业与消费者得以从事日常交易。然而,可信未必依据理性评估,动物精神(直觉)尝让人误以为,此时乃购房或购股良机,从而盲目自信,景气时仓促决定,等市场反转,愈发焦虑,自信变为恐慌。情绪化决策类似认知偏误,常导致不良投资结果。(The Science of Bubbles & Busts by Gary Stix Scientific American Sept. 2009)

2009年,席勒与阿克尔洛夫(George A. Akerlof )合著《动物精神》,论述人类心理如何驱动经济,以及影响全球资本主义。

《动物精神》前言:了解经济如何运行,如何管理有方,兴旺发达,须注重思想模式,激发众人信念、情感,以及动物精神。了解重大经济活动,惟有直面现实,动机多属禀性。

亚当·斯密思维实验(Gedankenexperiment【哲】指仅在想象或思维试验)估及世人均理性追求经济利益。的确如此,但其思维实验并未考虑众人非经济诱因,也未考虑非理性或误入歧途,从而忽略动物精神。

对比而言,凯恩斯则力图解释充分就业偏差,注重动物精神的重要性,强调动物精神对商人估算的关键作用。“对于投资铁路、铜矿、纺织厂、专利药品商誉、远洋班船、伦敦城区建筑物等,吾人估算其十年后收益的知识少之又少,乃至一无所知。”(The General Theory of Employment, Interest and Money Chapter 12. The State of Long-Term Expectation III)如世人极不确定,何以决策?只能“出于动物精神,”出于“自发驱策行动”,正如理性经济理论所言,决策不以“定量效益乘以定量概率所获加权平均数之结果。”

凯恩斯《通论》第十二章 VII率先述及“动物精神”(animal spirits),徐毓枬先生译“一时血气之冲动”;高鸿业先生译“动物本能”;《英汉大辞典》释为“生气,(身心的)健旺”,而《动物精神》诠释如下:

animal spirits源自古代及中古拉丁语spiritus animalis, animal意为 of the mind(心理;知识;才智;理智;精神;见解;思想倾向;意向)或animating(生气勃勃;赋予生命;激励;驱动),意指基本心智能量及生命力。但就现代经济学而言,animal spirits则另有所指;属经济学术语,指经济中多变且易变因素;关涉含糊或无常,常让世人气馁,然而,也常促人振作,激发活力,去克服畏惧心理和优柔寡断。

《通论》第十二章 长期预期状态(The State of Long-Term Expectation)VII

Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than on a mathematical expectation, whether moral or hedonistic or economic. Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as a result of animal spirits — of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.

参考译文:不稳定起因于投机,除此,亦因人性特征,世人积极行动,大抵取决于自发乐观,而非精确预期,无论道德、享乐抑或经济。或许,众人大多决意主动而为,即使结果数天后始知,必出于动物精神,即自发驱策行动,而非无所作为,且不以定量效益乘以定量概率所获加权平均数之结果。

Enterprise only pretends to itself to be mainly actuated by the statements in its own prospectus, however candid and sincere. Only a little more than an expedition to the South Pole, is it based on an exact calculation of benefits to come. Thus if the animal spirits are dimmed and the spontaneous optimism falters, leaving us to depend on nothing but a mathematical expectation, enterprise will fade and die; — though fears of loss may have a basis no more reasonable than hopes of profit had before.

参考译文:企业创办声明,无论说得多么坦诚,实属自欺欺人。基于精确预测利得,仅较南极探险聊胜一筹。因此,如动物精神萎靡,自发乐观情绪低落,一切仅凭期望值,企业必将衰败而亡;虽说担忧亏损与期盼利润均无合理依据。

It is safe to say that enterprise which depends on hopes stretching into the future benefits the community as a whole. But individual initiative will only be adequate when reasonable calculation is supplemented and supported by animal spirits, so that the thought of ultimate loss which often overtakes pioneers, as experience undoubtedly tells us and them, is put aside as a healthy man puts aside the expectation of death.

参考译文:确切而言,企业冀望未来有所作为,必造福社会。然而,合理测算须经动物精神强化并支持,个人方思进取,因此,即使经验表明,最终亏损尝使创业者困顿,此念也置之不顾,一如健康人将生死置诸度外。

经济学家大多夸夸其谈,而凯恩斯与众不同,早年参与价值投资,炒股炒汇,虽有亏有赢,经营保险公司,主掌英国财政部,如此历练,成就凯氏“货币三论”。

1923年末,凯恩斯出版《货币改革论》(A Tract on Monetary Reform),不久即着手撰述《货币论》(A Treatise on Money),延至1930年底面世。《货币论》(上下卷)专注纯货币理论,虽受哈耶克(F. A. Hayek)等经济学家批评,且凯恩斯也自认为著述不尽完善。然而,瑕不掩瑜,时至今日,这部经典之作仍具理论价值及现实意义,英文典雅,永传于世。

《货币论》作者序(AUTHOR'S PREFACE)

In Books III and IV of this treatise I propose a novel means of approach to the fundamental problems of monetary theory. My object has been to find a method which is useful in describing, not merely the characteristics of static equilibrium, but also those of disequilibrium, and to discover the dynamical laws governing the passage of a monetary system from one position of equilibrium to another. This discussion constitutes the kernel of volume I on The Pure Theory of Money. In volume 2, on The Applied Theory of Money, I have endeavoured to combine the quantitative method with the qualitative and have made as good an estimate as I can of the order of magnitude of the quantities entering into the argument, on the basis, mainly, of present-day facts in Great Britain and the United States. In this volume I have also described the salient features of modern banking and monetary systems, and have discussed the objects and methods of monetary management in the practical sphere.

参考译文:拙论第三及第四篇旨在以全新方法,探讨货币理论主要问题,不仅记述静态均衡特性,亦叙述失衡特性,并揭示货币体系均衡状况过渡之动态规律。此论即卷一“货币纯粹理论”要点。卷二“货币应用理论”意在综合定量与定性,尽量估算论证所涉数量级,其主要依据为英美当今实情。此卷还论及现代银行及货币体系显著特点,并讨论日常领域货币管理目的与方式。

第一章货币分类 (六)历史例证(ILLUSTRATIONS FROM HISTORY)

When the kings of Lydia first struck coins, it may have been as a convenient certificate of fineness and weight, or a mere act of ostentation appropriate to the offspring of Croesus(吕底亚末代国王,敛财成巨富)and the neighbours of Midas(小亚细亚中西部古国Phrygia国王,贪婪财富,能点物成金). The stamping of pieces of metal with a trade mark was just a piece of local vanity, patriotism or advertisement with no far-reaching importance. It is a practice which has never caught on in some important commercial areas. Egypt never coined money before the Ptolemies, and China (broadly speaking) has never coined silver, which is its standard of value, until the most recent times. The Carthaginians were reluctant coiners, and perhaps never coined except for foreign activities. The Semitic races, whose instincts are keenest for the essential qualities of money, have never paid much attention to the deceptive signatures of mints, which content the financial amateurs of the North, and have cared only for the touch and weight of the metal. It was not necessary, therefore, that talents(古希腊、罗马、中东等地的重量或货币单位)or shekels(古希伯来、巴比伦等地的重量或货币单位,约为1/2盎司)should be minted; it was sufficient that these units should be State-created in the sense that it was the State which defined (with the right to vary its definition from time to time) what weight and fineness of silver would, in the eyes of the law, satisfy a debt or a customary payment expressed in talents or in shekels of silver.

参考译文:吕底亚诸王首次铸币,或因便于证明其纯度与含金量,或仅适于克罗伊斯后裔及迈达斯友邻炫耀。金属硬币压印商标,仅为本埠虚荣、爱国或广告,并无深义,也从未流行于某些重要商业区。托勒密王朝之前,埃及从未铸币,白银虽为中国价值标准,但概括而言,直至近期才用以铸币。迦泰基人或因涉外活动才勉强铸币。闪语族对货币本质具直觉,极其精明,仅操心银币印戳与重量,而不太关心铸币厂虚假印记,因这只为满足北方金融外行。故此,无须铸造塔兰特或谢克尔银币;此类货币单位应由国家创制,就其意义而言,国家依法规定,(并有权不时修改规定)什么银币重量和纯度,足以偿付塔兰特或谢克尔银币债务或常规付款。

凯恩斯才华横溢,笔力又足以驾驭之,无论撰写学术著作,还是信笔散文,皆意到笔随,文字或典雅,或洗练,尽显凯氏文风。1933年,凯恩斯出版《传记随笔》(Essays in Biography),侧重传记,偶尔述及洛克(John Locke)之后250年间,为英伦思想奠基的智识精英。

Lord Oxford(牛津勋爵)

Lord Oxford ...... could be the leader of a nation or of a party; he would hasten to protect a friend or a colleagues, but he disdained to protect himself to a degree scarcely compatible with the actual conditions of contemporary life. Yet it was probably this course of behaviour, this element of character, which, increasingly with years, moulded for him the aspect of dignity, the air of sweetness and calm, the gentle ruggedness of countenance, which those who knew him after he had finally left office will carry in their memories as characteristically his.

参考译文:牛津勋爵 ...... 或可领导国家或政党,奋力保护朋友或同僚,不惜舍己,乃至不得以常理断之。然或许如此举止,如此品行,岁月如流,造就其庄严,淡定、亲和之风度,温和、坚毅之表情。勋爵告老之后,其品德至今传为美谈。

Newton, the Man(牛顿其人)

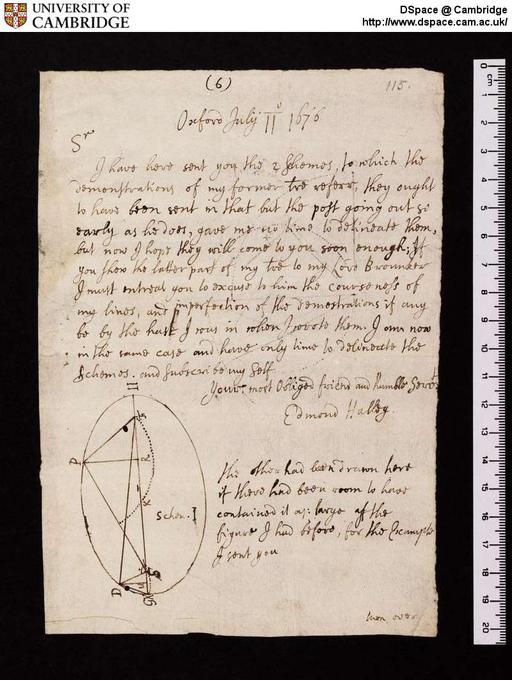

1696年,牛顿告别剑桥,将数千页手稿封存,计800多万字。1727年,牛顿辞世,手稿由外甥女凯瑟琳(Catherine Barton)及丈夫继承,尔后,又流转朴茨茅斯家族(Portsmouth family)。1872年,朴茨茅斯家族将涉及科学手稿捐剑桥大学。1936年,凯瑟琳后人(Lord Lymington)陷财务困境,将其余手稿交苏富比拍卖行,手稿遂流散全球。对此,凯恩斯愤懑不已,抢救性收藏约150多万字手稿,多涉炼金术研究。

凯恩斯研读牛顿手稿有年,认为这位天才并非理性时代先驱,而是最后的巫师。1942年,英国皇家学会纪念牛顿诞辰300周年,凯恩斯撰写演讲稿“牛顿其人”(Newton, the Man),由此,众人始知,牛顿科学才智与神学、炼金术及占星术并存,重新认识牛顿的伟大与超凡。

剑桥大学藏牛顿手稿

I believe that Newton was different from the conventional picture of him. But I do not believe he was less great. He was less ordinary, more extraordinary, than the nineteenth century cared to make him out. Geniuses are very peculiar. Let no one here suppose that my object today is to lessen, by describing, Cambridge's greatest son. I am trying rather to see him as his own friends and contemporaries saw him. And they without exception regarded him as one of the greatest of men.

参考译文:鄙人以为,牛顿并非世人设想那样,然而,其伟大亦未因此而削弱。牛顿并非19世纪精心描述那么平凡,反而超凡。天才尽显特异。希望诸位不要误解,以为鄙人所述贬低剑桥伟大之子,而以友朋及同侪看待牛顿,将其视为最伟大人物之一。

As one broods over these queer collections, it seems easier to understand - with an understanding which is not, I hope, distorted in the other direction - this strange spirit, who was tempted by the Devil to believe at the time when within these walls he was solving so much, that he could reach all the secrets of God and Nature by the pure power of mind Copernicus and Faustus in one.

参考译文:世人关注这些怪异藏品,似乎较易理解,但愿不要曲解,这个奇异魂灵,备受魔鬼诱惑,在皇家协会围墙之内,解决诸多难题,自信集哥白尼与浮士德于一身,凭借纯粹心智,破解上帝与自然所有隐秘。

1938年9月初,凯恩斯应邀为Memoir Club(传记学会)撰My Early Beliefs(我的早期信仰),文笔精粹,记述摩尔(G. E. Moore)如何使其与朋友皈附真善美,形成百花里文化沙龙(Bloomsbury Group)的灵性氛围。

《我的早期信仰》开头忆及与小说家劳伦斯(D. H. Lawrence)会面,凯氏与罗素出身贵族,而劳伦斯是矿工之子,双方隔阂之深,几无话可谈。劳伦斯对那次聚会充满怨恨,致函好友加尼特(David Garnett):痛苦、敌意、狂怒,使我发疯(sent me mad with misery and hostility and rage),而凯恩斯记述淡然,暗含讥讽:

1914年,我与劳伦斯会面的情景,仍历历在目(邦尼觉得似乎是1915年,但我记得或更早些。)他在信中提及,邦尼在学会最后会晤引述。但遗憾的是,我不记得任何片言只语,虽残留些许模糊之感。(I can visualise very clearly the scene of my meeting with D. H. Lawrence in 1914 (Bunny seems to suggest 1915, but my memory suggests that it may have been earlier than that) of which he speaks in the letter from which Bunny quoted at the last meeting of the Club. But unfortunately I cannot remember any fragment of what was said, though I retain some faint remains of what was felt.)

伯蒂·罗素在纳维尔庭院房间设早宴,就我们三人。我猜想,劳伦斯一直跟伯蒂在一起,而昨夜应有会议或宴会,让劳伦斯一睹剑桥。或许他并不快活,记得他从一开始就显得阴郁,一上午沉默寡言,偶尔含混,焦躁地表示异议。(It was at a breakfast party given by Bertie Russell in his rooms in Nevile's Court. There were only the three of us there. I fancy that Lawrence had been staying with Bertie and that there had been some meeting or party the night before, at which Lawrence had been facing Cambridge. Probably he had not enjoyed it. My memory is that he was morose from the outset and said very little, apart from indefinite expressions of irritable dissent, all the morning.)

几乎只有伯蒂与我交谈,至于谈什么,则毫无印象,但绝非我俩独处时那种漫谈。试图让劳伦斯加入交谈,但未太奏效。我们将沙发拉近,围坐壁炉。劳伦斯坐在右手侧,蜷伏着,垂头。时不时,伯蒂在壁炉旁站起,我想我也起身。我离开时觉得,聚会不欢而散,我们再无交往,记忆仅此而已。诸位应知此类场合,两位密友当着访客面交谈。此前我与他从未谋面,以后再也没见过。多年之后,他在信函记载,并刊印书信集发表,说我是百花里文化沙龙(The Bloomsbury Group)唯一成员,订购《查泰莱夫人的情人》(Lady Chatterley's Lover),以表支持。(Most of the talk was between Bertie and me, and I haven't the faintest recollection of what it was about. But it was not the sort of conversation we should have had if we had been alone. It was at Lawrence and with the intention, largely unsuccessful, of getting him to participate. We sat round the fireplace with the sofa drawn across. Lawrence sat on the right-hand side in rather a crouching position with his head down. Bertie stood up by the fireplace, as I think I did, too, from time to time. I came away feeling that the party had been a failure and that we had failed to establish contact, but with no other particular impression. You know the sort of situation when two familiar friends talk at a visitor. I had never seen him before, and I never saw him again. Many years later he recorded in a letter, which is printed in his published correspondence, that I was the only member of Bloomsbury who had supported him by subscribing for Lady Chatterley.)

02

凯恩斯曾言:经济学家与政治哲学家思想,无论正确与否,其影响之大,超乎常人理解,统治世界惟此思想而已。务实者自以为不受任何学理影响,尝沦为某已故经济学家之奴隶。(The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. The General Theory of Employment, Interest and Money, Ch. 24 "Concluding Notes" )

世间经济学家芸芸,然而,其思想足以影响当代经济乃至社会进程者寥寥。

好事之徒常将凯恩斯与哈耶克(Friedrich Hayek)说成宿敌。诚然,两位经济学巨擘学术观点相异,但私交甚笃。《经济学人》刊文Was John Maynard Keynes a liberal?(The Economist Aug. 8, 2018),述及两人交往:

1944年,哈耶克收到一封函件,邮自新泽西州大西洋城克拉里奇酒店(Claridge Hotel)客人,祝贺这位奥地利裔经济学家出版“力作”《通往奴役之路》(The Road to Serfdom),认为计划经济对自由隐伏威胁。信中写道:“鄙人从道德及哲学层面,深表赞同。”

致函哈耶克者是凯恩斯,当时,正赶赴新罕布什尔州,出席布雷顿森林会议,协助规划战后经济秩序。信写得情真意切,让人颇感意外,原以为,哈耶克乃撒切尔自由市场精神教父,而凯恩斯则是积极引导资本主义守护神。

然而,凯恩斯与诸多追随者不同,并非左派。1925 年,凯氏在《我是自由主义者吗?》一文写道:“阶级之争中,我属有教养之中产阶级。”其后,形容工会主义者为“暴君,其自私及帮派式自命不凡应予痛斥。”指责英国工党领袖如“陈腐教义之信徒,”“含糊唠叨过时,支离的费边马克思主义。”他还声言:“收入与财富多寡不均,自有其社会及心理之正当理由。”(虽然并非指当时的巨大差别)。

那么,凯恩斯为何倡导凯恩斯主义?显然,因1930年代,英国遭遇大萧条,摧毁民众对放任资本主义的信念。但凯恩斯的某些观点早已提出。

凯恩斯属新生自由主义者,未受自由放任主义迷惑。此说主张“不受制约的私营企业可最大限度地促进整体利益。” 凯恩斯认为,该学说在理论上必不正确,在实践中不再有用。国家须根据是非曲直,权衡什么让个人自主,什么应由国家承担。

凯恩斯及其他自由主义者做此决定时,还得应对社会主义与民族主义,革命和反革命的威胁。迫于工党日益强大的政治影响,1911年,自由党政府致力改革,推行强制国民保险,为辛勤工作的穷人提供病假工资、产妇津贴,以及限额失业救济金。此类自由主义者将失业工人视为国家资产,不应因并非自身过失而“陷入贫困”。

凯恩斯致函哈耶克,确认从道德及哲学层面赞同《通往奴役之路》,但对其经济学说不以为然。英国几乎肯定需要更多,而非更少计划经济,并在《通论》指明“某种程度的投资全面社会化”。

凯恩斯致函哈耶克,认为,如计划实施者与哈耶克道德立场一致,那么,适度计划是安全的。计划者勉为其难最为理想。凯恩斯主义交由哈耶克派执行,再好不过。

至于凯恩斯与弗里德曼(Milton Friedman)之争,沃尔夫(Martin Wolf)概述足以说明(Keynes versus Friedman: both men can claim victory Financial Times Nov. 22, 2006):

凯恩斯(1946年辞世)与弗里德曼(上周去世)乃20世纪最具影响力的经济学家。由于弗里德曼竭力抨击凯恩斯遗教,世人便认定两人相互对立。的确,两人之间分歧深刻,但共同之处亦多。颇为有趣的是,他俩既不是赢家,也不是输家:当今正统经济政策,综合两者学说。

凯恩斯总结“大萧条”,认为自由市场已告失败;弗里德曼则认定:美联储反而失败。凯恩斯坚信,官僚(如自己之类)练达而决断;而弗里德曼认为,政府受到严格规则制约才可依赖。凯恩斯以为,资本主义应加以束缚;而弗里德曼主张,不加干预,资本主义必正常运行。

政见相左不言而喻,然相似之处亦多。两人均为优秀记者、辩论家及创见倡导者,都认为,大萧条本质上属一场危机,因总需求不足而导致;都撰文赞同浮动汇率,以及名义(或法定)货币;在20世纪重大意识形态斗争中,都倡导自由。

原标题:《夜读偶录 :凯恩斯以文传世》

本文为澎湃号作者或机构在澎湃新闻上传并发布,仅代表该作者或机构观点,不代表澎湃新闻的观点或立场,澎湃新闻仅提供信息发布平台。申请澎湃号请用电脑访问http://renzheng.thepaper.cn。

- 报料热线: 021-962866

- 报料邮箱: news@thepaper.cn

互联网新闻信息服务许可证:31120170006

增值电信业务经营许可证:沪B2-2017116

© 2014-2024 上海东方报业有限公司